Unemployment:

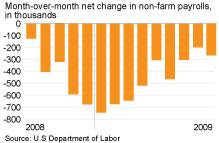

Unemployment: Even the worst estimate (260,000) missed

today's reported job losses. The rise of unemployment to 9.8% was expected, marking the 21st increase in the the employment rate. September’s losses bring total jobs lost since the recession began in December 2007 to 7.6 million, making the total number of unemployed 15.1 million. No one sees anything positive happening on the labor front for over a year, and even optimists are predicting ten percent unemployment by the end of the year and near that level throughout 2010, even if the economy were to start growing overnight. Once shown as the evidence that this recession was not a Depression, the unemployment rate has seemed entrenched, persisting and even growing despite positive trends in other areas such as residential real estate and overall home prices.

Today’s labor report also showed the average work week shrank to 33 hours in September, matching a record low, from 33.1 hours in the prior month. Average weekly hours worked by production workers dipped to 39.8 hours from 39.9 hours, while overtime decreased to 2.8 hours from 2.9 hours. That brought the average weekly earnings to $616.11 from $617.65.

Banks: The banking industry saw a surprise move by Bank of America's CEO Kenneth Lewis resigning without a successor in place. Add to this the reality that we aren't nearly done unwinding the financial mess, and the future isn't looking so bright for banks. The three mega-banks now hold an estimated 10 percent of all deposits, and we haven't seen the impact of commercial real estate yet.

On the banking front, CIT Group Inc launched on Thursday a debt-exchange plan to prevent it from filing for bankruptcy. CIT also asked bondholders to approve a prepackaged plan of reorganization that would allow it to initiate a voluntary filing under Chapter 11 if the debt exchange failed. CIT lends primarily to small and mid-sized companies, and its failure could be seen as the Indy Mac of commercial lending. If CIT Group averts a bankruptcy filing by exchanging its debt, the U.S. government could lose nearly 80 percent of its $2.33 billion investment in the troubled commercial lender.

Auto Industry:

Auto Industry: The end of the government's popular Cash for Clunkers program and low inventories of vehicles led to a 40 percent plunge in U.S. auto sales in September compared with August, although year-over-year declines were more modest and generally in line with forecasts. Overall industry sales came in at 745,997 vehicles in September according to sales tracker Autodata, down 23 percent from a year ago. That makes it the worst month since February in what has been a terrible year for auto sales, even with the four-week lift the industry received from the Clunkers program. The one major automaker to post improved sales in September was Korea's Hyundai, which reported a 27 percent gain from a year ago. Still, Hyundai's sales were 48 percent lower than August's levels. Chrysler's sales plunged 42 percent from a year ago, and 33 percent from August. Chrysler, with a heavier reliance on trucks than other automakers, did not get as much of a sales lift from the Clunkers program. But Edmunds.com had expected an even worse year-over-year drop of 48 percent.

General Motors Co. said it will close the Saturn brand after Penske Automotive Group Inc. broke off discussions to buy the unit. Saturn dealers will have until October 2010 to wind down operations, affecting 13,000 jobs and 350 dealerships.

"We believe the remainder of 2009 will continue to be a challenge for the U.S. automotive market," said Peter Fong, the lead sales executive for the Chrysler Group in a statement. "Credit markets have thawed slightly, but still remain tight, and consumer confidence, as we saw in September, is tenuous."

Consumer Spending: Hold onto your seats and hats, because all but one (Obama's approval rating) of

gallup's daily indicators went into negative territory yesterday. The big news in this is that

consumer spending seems to have a new normal in the mid-sixty range, not good news for the long term health of a consumer-driven economy. This new normal is persitant, even though

consumer confidence hit a 21-month high last week.

Market: The DOW shed over 200 points yesterday, and today's labor numbers only made the news seem worse. Add to that the report by the IMF that even more money might be needed from cash-strapped countries, and it doesn't seem an end to this recession is in sight.

Unemployment: Even the worst estimate (260,000) missed today's reported job losses. The rise of unemployment to 9.8% was expected, marking the 21st increase in the the employment rate. September’s losses bring total jobs lost since the recession began in December 2007 to 7.6 million, making the total number of unemployed 15.1 million. No one sees anything positive happening on the labor front for over a year, and even optimists are predicting ten percent unemployment by the end of the year and near that level throughout 2010, even if the economy were to start growing overnight. Once shown as the evidence that this recession was not a Depression, the unemployment rate has seemed entrenched, persisting and even growing despite positive trends in other areas such as residential real estate and overall home prices.

Today’s labor report also showed the average work week shrank to 33 hours in September, matching a record low, from 33.1 hours in the prior month. Average weekly hours worked by production workers dipped to 39.8 hours from 39.9 hours, while overtime decreased to 2.8 hours from 2.9 hours. That brought the average weekly earnings to $616.11 from $617.65.

Banks: The banking industry saw a surprise move by Bank of America's CEO Kenneth Lewis resigning without a successor in place. Add to this the reality that we aren't nearly done unwinding the financial mess, and the future isn't looking so bright for banks. The three mega-banks now hold an estimated 10 percent of all deposits, and we haven't seen the impact of commercial real estate yet.

On the banking front, CIT Group Inc launched on Thursday a debt-exchange plan to prevent it from filing for bankruptcy. CIT also asked bondholders to approve a prepackaged plan of reorganization that would allow it to initiate a voluntary filing under Chapter 11 if the debt exchange failed. CIT lends primarily to small and mid-sized companies, and its failure could be seen as the Indy Mac of commercial lending. If CIT Group averts a bankruptcy filing by exchanging its debt, the U.S. government could lose nearly 80 percent of its $2.33 billion investment in the troubled commercial lender.

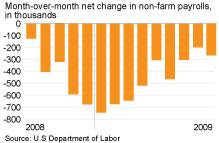

Unemployment: Even the worst estimate (260,000) missed today's reported job losses. The rise of unemployment to 9.8% was expected, marking the 21st increase in the the employment rate. September’s losses bring total jobs lost since the recession began in December 2007 to 7.6 million, making the total number of unemployed 15.1 million. No one sees anything positive happening on the labor front for over a year, and even optimists are predicting ten percent unemployment by the end of the year and near that level throughout 2010, even if the economy were to start growing overnight. Once shown as the evidence that this recession was not a Depression, the unemployment rate has seemed entrenched, persisting and even growing despite positive trends in other areas such as residential real estate and overall home prices.

Today’s labor report also showed the average work week shrank to 33 hours in September, matching a record low, from 33.1 hours in the prior month. Average weekly hours worked by production workers dipped to 39.8 hours from 39.9 hours, while overtime decreased to 2.8 hours from 2.9 hours. That brought the average weekly earnings to $616.11 from $617.65.

Banks: The banking industry saw a surprise move by Bank of America's CEO Kenneth Lewis resigning without a successor in place. Add to this the reality that we aren't nearly done unwinding the financial mess, and the future isn't looking so bright for banks. The three mega-banks now hold an estimated 10 percent of all deposits, and we haven't seen the impact of commercial real estate yet.

On the banking front, CIT Group Inc launched on Thursday a debt-exchange plan to prevent it from filing for bankruptcy. CIT also asked bondholders to approve a prepackaged plan of reorganization that would allow it to initiate a voluntary filing under Chapter 11 if the debt exchange failed. CIT lends primarily to small and mid-sized companies, and its failure could be seen as the Indy Mac of commercial lending. If CIT Group averts a bankruptcy filing by exchanging its debt, the U.S. government could lose nearly 80 percent of its $2.33 billion investment in the troubled commercial lender.

Auto Industry: The end of the government's popular Cash for Clunkers program and low inventories of vehicles led to a 40 percent plunge in U.S. auto sales in September compared with August, although year-over-year declines were more modest and generally in line with forecasts. Overall industry sales came in at 745,997 vehicles in September according to sales tracker Autodata, down 23 percent from a year ago. That makes it the worst month since February in what has been a terrible year for auto sales, even with the four-week lift the industry received from the Clunkers program. The one major automaker to post improved sales in September was Korea's Hyundai, which reported a 27 percent gain from a year ago. Still, Hyundai's sales were 48 percent lower than August's levels. Chrysler's sales plunged 42 percent from a year ago, and 33 percent from August. Chrysler, with a heavier reliance on trucks than other automakers, did not get as much of a sales lift from the Clunkers program. But Edmunds.com had expected an even worse year-over-year drop of 48 percent.

General Motors Co. said it will close the Saturn brand after Penske Automotive Group Inc. broke off discussions to buy the unit. Saturn dealers will have until October 2010 to wind down operations, affecting 13,000 jobs and 350 dealerships.

"We believe the remainder of 2009 will continue to be a challenge for the U.S. automotive market," said Peter Fong, the lead sales executive for the Chrysler Group in a statement. "Credit markets have thawed slightly, but still remain tight, and consumer confidence, as we saw in September, is tenuous."

Consumer Spending: Hold onto your seats and hats, because all but one (Obama's approval rating) of gallup's daily indicators went into negative territory yesterday. The big news in this is that consumer spending seems to have a new normal in the mid-sixty range, not good news for the long term health of a consumer-driven economy. This new normal is persitant, even though consumer confidence hit a 21-month high last week.

Market: The DOW shed over 200 points yesterday, and today's labor numbers only made the news seem worse. Add to that the report by the IMF that even more money might be needed from cash-strapped countries, and it doesn't seem an end to this recession is in sight.

Auto Industry: The end of the government's popular Cash for Clunkers program and low inventories of vehicles led to a 40 percent plunge in U.S. auto sales in September compared with August, although year-over-year declines were more modest and generally in line with forecasts. Overall industry sales came in at 745,997 vehicles in September according to sales tracker Autodata, down 23 percent from a year ago. That makes it the worst month since February in what has been a terrible year for auto sales, even with the four-week lift the industry received from the Clunkers program. The one major automaker to post improved sales in September was Korea's Hyundai, which reported a 27 percent gain from a year ago. Still, Hyundai's sales were 48 percent lower than August's levels. Chrysler's sales plunged 42 percent from a year ago, and 33 percent from August. Chrysler, with a heavier reliance on trucks than other automakers, did not get as much of a sales lift from the Clunkers program. But Edmunds.com had expected an even worse year-over-year drop of 48 percent.

General Motors Co. said it will close the Saturn brand after Penske Automotive Group Inc. broke off discussions to buy the unit. Saturn dealers will have until October 2010 to wind down operations, affecting 13,000 jobs and 350 dealerships.

"We believe the remainder of 2009 will continue to be a challenge for the U.S. automotive market," said Peter Fong, the lead sales executive for the Chrysler Group in a statement. "Credit markets have thawed slightly, but still remain tight, and consumer confidence, as we saw in September, is tenuous."

Consumer Spending: Hold onto your seats and hats, because all but one (Obama's approval rating) of gallup's daily indicators went into negative territory yesterday. The big news in this is that consumer spending seems to have a new normal in the mid-sixty range, not good news for the long term health of a consumer-driven economy. This new normal is persitant, even though consumer confidence hit a 21-month high last week.

Market: The DOW shed over 200 points yesterday, and today's labor numbers only made the news seem worse. Add to that the report by the IMF that even more money might be needed from cash-strapped countries, and it doesn't seem an end to this recession is in sight.